A Biased View of What Is Medigap

Getting My Medigap To Work

Table of ContentsFascination About Medigap BenefitsThe smart Trick of Medigap That Nobody is Talking AboutThe 8-Second Trick For Medigap6 Easy Facts About How Does Medigap Works ShownThe 5-Minute Rule for What Is Medigap

Medigap is Medicare Supplement Insurance policy that helps fill up "spaces" in Original Medicare and also is sold by personal companies. Original Medicare spends for a lot, however not all, of the cost for protected wellness treatment services as well as supplies. A Medicare Supplement Insurance (Medigap) policy can assist pay some of the staying wellness care prices, like: Copayments Coinsurance Deductibles Keep In Mind Note: Medigap prepares offered to people brand-new to Medicare can no much longer cover the Part B deductible.Nonetheless, if you were eligible for Medicare prior to January 1, 2020, yet not yet enrolled, you may be able to get among these strategies that cover the Part B deductible (Plan C or F). If you already have or were covered by Strategy C or F (or the Plan F high insurance deductible variation) prior to January 1, 2020, you can maintain your plan.

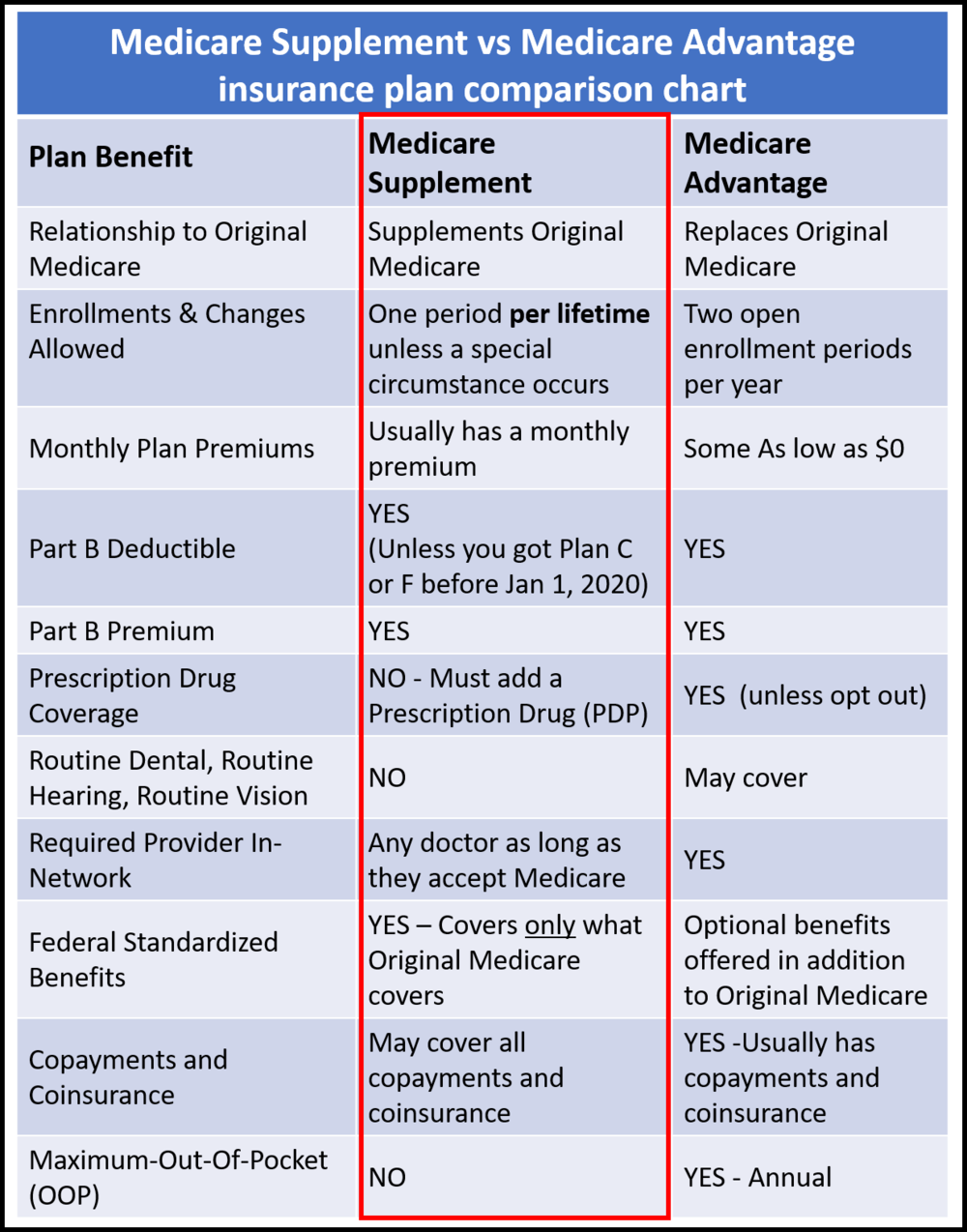

A Medigap policy is different from a Medicare Benefit Plan. Those strategies are methods to obtain Medicare benefits, while a Medigap plan just supplements your Original Medicare benefits.

You pay this regular monthly costs in addition to the monthly Component B costs that you pay to Medicare. A Medigap policy only covers one individual. If you and also your spouse both desire Medigap coverage, you'll each need to purchase different plans. You can purchase a Medigap policy from any type of insurer that's accredited in your state to sell one.

The 9-Minute Rule for What Is Medigap

A Medigap strategy (additionally called a Medicare Supplement), marketed by personal firms, can help pay a few of the healthcare expenses Original Medicare doesn't cover, like copayments, coinsurance and also deductibles. Some Medigap strategies likewise provide protection for services that Original Medicare does not cover, like treatment when you take a trip outside the united state

Some steps you might desire to take consist of the following: Make certain you are eligible to purchase a Medigap. Bear in mind that you can just have a Medigap if you have Original Medicare. If you are enrolled in a Medicare Advantage Plan, Medigaps can not be offered to you. There may be various other Medigap eligibility needs that apply to you, depending on the state in which you live.

The Only Guide to How Does Medigap Works

If you have just recently registered in Medicare, you might have listened to of Medigap strategies and asked yourself exactly how they function. Medigap plans, also recognized as Medicare Supplement policies, assistance cover some out-of-pocket costs associated with Original Medicare.

When you register, your Visit Website Medicare Benefit Strategy takes control of the management of your Medicare Component navigate to these guys An and Medicare Part B coverage. Medigaps are planned merely to cover the Medicare costs that Original Medicare delegates the beneficiary. If you have a Medigap plan, Medicare pays its share of the Medicare-approved quantity for protected solutions and afterwards your Medigap plan will certainly pay its share of covered benefits.

In 2022 with Strategy F, you can expect to pay in between $160 and $300. Strategy G would usually range in between $90 as well as $150, as well as Plan N would certainly be around $78 to $140. medigap.

The Best Strategy To Use For What Is Medigap

Registering in a Medicare Supplement insurance coverage plan will help in covering costs. Step 1: Determine which benefits you want, then choose which of the Medigap plan kinds (letter) satisfies your needs. Step 2: Learn which insurance provider sell Medigap plans in your state. Step 3: Discover concerning the insurance business that market the Medigap plans you have an interest in and contrast expenses.

The ideal time to request a Medicare Supplement strategy is throughout your six-month find this Medigap Open Enrollment Period. The Open Registration Period starts the first month you have Part B coverage and also you're 65 or older. Due to the fact that Medigap plans are provided by personal insurance provider, they are typically enabled to utilize clinical underwriting to determine whether or not to approve your application and what your expense will be.

The list below factors can affect the price of Medicare Supplement plans: Your location Your gender Your age Cigarette use Home discount rates Just how you pay When you enlist Medigap premiums must be approved by the state's insurance coverage division and are set based on plan background as well as operating costs. There are three ratings made use of that can impact your prices and price boosts.

Concern Age does not imply the strategy will certainly not see a rate boost. You will usually pay more when you're younger however less as you age.

Not known Facts About What Is Medigap

Area Rated: Area score suggests every person in the neighborhood pays the same rate. Most states and also carriers use the obtained age ranking when pricing their Medicare Supplement insurance policy.